Construction in 2025 was defined by rapid pivots and jarring reversals. Policy shifts, legal battles, labor pressures, and accelerating technology adoption reshaped risk in real time. For contractors operating on thin margins and fixed-price contracts, the year demanded faster decision-making, tighter controls, and better visibility across projects and partners.

What began with uncertainty gradually evolved into something more instructive: a clearer picture of how the industry must operate going forward.

Took the Industry on a Rollercoaster Ride

Early in the year, tariff announcements from the Trump administration caught many fixed-price builders off guard. Material producers and logistics providers absorbed higher costs and, in some cases, lost export sales, prompting concerns about reduced construction spending across the supply chain.

The ripple effects were immediate. Builder’s risk insurance premiums rose as material and labor costs increased. Insurers responded with more complex underwriting models, quota-share arrangements, and deeper preconstruction risk assessments. Contractors leaned more heavily on price-escalation clauses and early procurement strategies to protect margins.

Internationally, the situation intensified when Canada blocked bids from U.S. contractors on public projects, tightening backlogs for publicly traded construction multinationals.

By May, however, the panic had eased. A May 1 poll in AGC SmartBrief found that 44% of respondents were less concerned about tariffs than they had been just weeks earlier. While some project owners paused major investments until conditions stabilized, large firms such as Graycor and Granite Construction indicated the landscape felt more manageable.

The lesson: volatility may be unavoidable, but adaptability is not optional.

Project Labor Agreements Followed a Similar Path

Project labor agreements (PLAs) mirrored the broader uncertainty of the year.

Federal agencies began 2025 under Executive Order 14063 and FAR rules that generally require PLAs on large federal projects unless exceptions apply. But court challenges quickly complicated matters. A Court of Federal Claims decision in MVL USA found a PLA mandate unlawful as applied to certain procurements, forcing agencies to reevaluate their approach.

Some responded with sweeping pullbacks. The Department of Defense issued a deviation discouraging PLAs, while the General Services Administration (GSA) carved out a class exception for Land Ports of Entry projects.

Those blanket moves were short-lived. A federal injunction in NABTU v. DoD and GSA halted broad prohibitions and reaffirmed the need for project-by-project determinations. By June, an Office of Management and Budget memo confirmed that EO 14063 remained in effect, discouraging blanket bans and emphasizing detailed market research.

Meanwhile, state and local agencies forged ahead independently. New York City announced PLAs covering more than $7 billion in capital projects. Virginia took a more measured route, requiring quantified benefits, independent review, and formal approval before adopting PLAs.

Across jurisdictions, one theme emerged: guardrails over one-size-fits-all mandates.

AI No Long a Curiosity for Contractors

2025 may ultimately be remembered as the year artificial intelligence moved from curiosity to competitive advantage in construction.

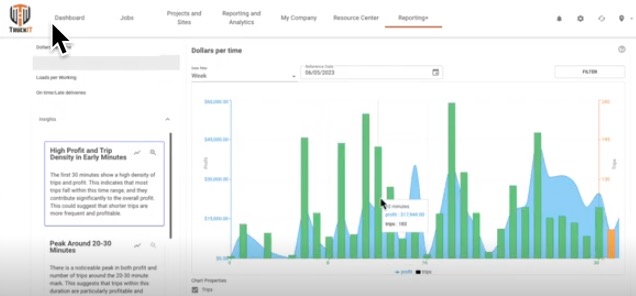

Pilot programs gave way to production deployments. At the Associated General Contractors of America convention, Hensel Phelps showcased its use of Track3D’s AI platform at San Francisco International Airport to track progress and identify errors. The use cases were no longer theoretical, they were operational.

According to an AGC survey, 44% of construction firms planned to increase investment in AI, the highest “increase” figure among all technologies evaluated. Workforce data reinforced the trend: 45% of firms expected AI and robotics to automate error-prone tasks, while 44% anticipated gains in safety and productivity.

Major technology vendors accelerated their efforts:

- Procore expanded its Helix intelligence layer, adding photo-based progress tracking, safety insights, multilingual support, and mobile access, along with an open beta for custom AI agents.

- Autodesk embedded Autodesk Assistant deeper into Revit, AutoCAD, and Civil 3D workflows.

- Trimble rolled out AI-powered tools for submittals, title block extraction, and project assistance.

Executives moved past experimentation toward conviction. The message was clear: better data and automation are no longer optional; they are foundational.

Data Center Demand Exploded

While contractors learned how to use AI, they also raced to build the infrastructure that powers it.

Data center construction emerged as the single strongest market in U.S. construction. Grand View Research estimates the market will grow at a 25.6% compound annual rate through 2030, reaching more than $219 billion.

Planned investments from companies like OpenAI and Microsoft are expected to create tens of thousands of construction jobs. Firms such as Skanska responded by unifying semiconductor and data center work under specialized divisions.

But the boom brought challenges. Power availability, grid upgrades, water use, noise concerns, and land conversion scrutiny intensified. Equipment shortages, particularly transformers and switchgear, slowed some schedules as resources were diverted to disaster recovery efforts.

As AGC Chief Economist Ken Simonson noted, most projects weren’t canceled, but mitigating cost increases and staying on schedule became significantly harder.

Layered on top of it all was the industry’s chronic labor shortage.

Immigration Enforcement Tightened an Already Tight Labor Market

In 2025, Immigration and Customs Enforcement activity added another layer of pressure. High-profile enforcement actions, such as arrests at Florida construction sites in May, put immigration compliance front and center.

Nearly one-third of firms surveyed by AGC and NCCER reported being affected by increased enforcement. Labor pools thinned. Projects slowed as companies verified worker status or sought replacements.

Policy responses were mixed. A proposed H-2C visa aimed to address labor shortages, while a new $100,000 fee on H-1B petitions made skilled labor visas significantly more expensive.

For an industry already struggling to staff projects, compliance and workforce planning became mission-critical.

Deregulation Offered Relief, and New Uncertainty

Not all federal actions were viewed negatively. The Trump administration issued executive orders aimed at streamlining procurement, accelerating defense contracting, and reducing compliance burdens, particularly for DOT contractors.

Environmental rollbacks reduced red tape but introduced uncertainty. While some firms welcomed lower regulatory costs, concerns around PFAS and other contaminants shifted responsibility toward states and municipalities. Larger jurisdictions adapted more easily, while rural areas struggled to fill regulatory gaps.

The result was a fragmented landscape, simpler in some respects, more complex in others.

If 2025 taught the construction industry anything, it’s this:

- Volatility is the new baseline

- Labor and material constraints are structural, not temporary

- Technology adoption is no longer optional

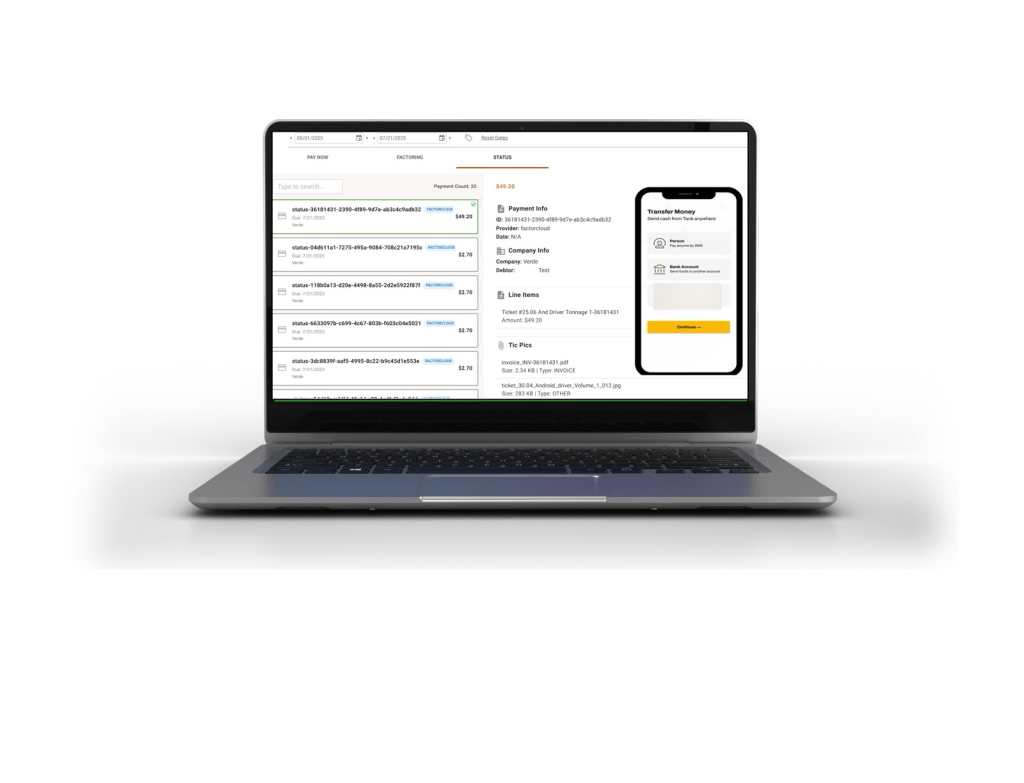

- Visibility, speed, and verified data matter more than ever

As contractors, haulers, and material suppliers move into 2026, success will hinge on tighter coordination across the jobsite, faster access to accurate data, and systems that adapt as conditions change, not weeks later, but in real time.

That’s the environment TruckIT was built for.

If you want clearer answers, tighter control, and fewer surprises heading into 2026, schedule a demo and see how real-time visibility actually works in the field.